Donald Trump's tax affairs are under the microscope.

Oh, that ordinary American taxpayers, about whom Donald Trump professes to worry sooooo much, could get a deal like a 1995 bonanza by which the US taxman gave the Republican presidential candidate a truly remarkable gift – a deduction so massive that he quite likely paid no federal income tax for almost 20 years.

It can reasonably be rounded to $1 billion. The actual amount was $916 million. And on the basis of three key pages extracted from Trump's 1995 tax papers and mysteriously mailed to The New York Times, tax experts estimate that the deduction would have amounted to a free pass for Trump's huge income for maybe 18 years.

The revelation comes on top of another unexplained deal by which the state of New Jersey, run by a Trump chum and campaign sidekick, Governor Chris Christie, wrote down a tax bill of close to $30 million for Trump's casinos, to what amounted to petty cash for the poor little rich man from New York – just $5 million or about 17 cents in the dollar and exceedingly more generous than was allowed for other casino operators on New Jersey's Atlantic City foreshore.

All American political candidates dread the euphemistic "October surprise" – a grenade that comes from out of left-field, packing enough political power to derail their campaign. The New York Times went live with its tax bonanza story late in the evening on Saturday, October 1 – so indeed it qualifies as an early October surprise for the GOP candidate.

Trump's political balls are bouncing badly. He emerged from the first candidates' debate on September 26 to a near unanimous view among analysts that the Democratic challenger Hillary Clinton had bested him – particularly by luring him into damaging admissions and bouts of his crazy-horse conduct that prompts questions about his temperamental suitability for the twin posts of president and commander-in-chief.

It was like a rerun of the aftermath of the July political convention season, when the Democrats were judged to have been superior performers, and Trump resorted to more than a week of behaviour that, politically, was near-suicidal – remember his merciless hounding of the immigrant Muslim family whose son had died heroically as a US Marine in Afghanistan?

It's been the same in the week since Trump's debate flame-out – he has been lashing, even with 3am-ish tweets, former Miss Universe Alicia Machado, who Clinton revealed in the debate to have been a victim of Trump's appalling sexism and misogyny.

Trump's pursuit of the woman was so fierce, so relentless and so gob-smackingly stupid, that the story consumed an entire week's media oxygen – so much so, that several likely lines of inquiry based on exchanges during the debate did not get the attention they deserved.

One was Trump's tax returns. When Clinton went after him on his refusal to abide by political tradition and release his tax returns, Trump was as passive as the proverbial stunned mullet.

Almost as though he has been Tasered, he watched in silence as Clinton went through various reasons for him not wanting ordinary Americans to see his returns.

When she got to the possibility that he had not paid tax for some years, Trump interjected with words that were much less a denial than the kind of billionaire's boast one might hear whispered at the golf club – but certainly not in a political exchange being telecast across the US and the globe.

"That makes me smart," Trump exclaimed.

Seconds later, he again seemed to confirm he had not paid tax by the nature of his response to another Clinton jab: "If he's paid zero, that means zero for troops, zero for vets, zero for schools or health."

Trump: "It would be squandered, too, believe me."

So, on the basis of The New York Times' report, maybe a billion bucks stayed in Trump's pocket – rather than be "squandered" on schools and hospitals, roads and bridges, and the other piffling indulgences that uppity American communities believe contribute to the quality of their life; and, of course, to which the poor mugs who religiously pay their taxes, do contribute.

Trump has argued that he can't release his returns because he is under audit by the Internal Revenue Service – which the IRS has said is no reason for Trump to not release his returns. One of his sons had argued cryptically, that releasing the returns would be "a distraction".

As before, at times in the coverage of matters American, we need to invoke a very important caveat – in the US, it's often conduct that is legal, not illegal, that is shocking.

Tax experts go out of their way to stress that what they can best glean on the calculations by which Trump's accountants arrived at a $916 million deduction in 1995, all is perfectly above board – legally, that is; not morally.

The three pages from several documents that were mailed to the Times – posted in New York and marked with Trump Tower as the sender's address – contain sufficient identifying information for authentication, and for experts to conclude that the deduction would have absolved Trump from paying any income tax on income of more than $50 million for 18 years.

Remember that Trump won this tax gift because he had run his businesses so badly – while doing OK for himself. Between 1995 and 2009 he took about $45 million in chairman's and other executive fees from the companies as stunned investors, who had believed his Midas-touch talk, saw their shares plummet from $35.50 to just 17 cents, bondholders got just "pennies in the dollar" and scores of contractors went unpaid.

Joel Rosenfeld, assistant professor at New York University's Schack Institute of Real Estate, told the Times: "He has a vast benefit from his destruction – do you realize you can create $916 million in income without paying a nickel in taxes?"

In a statement in response to the Times report, the Trump campaign did not deny its essential elements. It said: "Mr Trump is a highly skilled businessman who has a fiduciary responsibility to his business, his family and his employees to pay no more than that legally required.

"That being said, Mr Trump has paid hundreds of millions of dollars in property taxes, sales and excise taxes, real estate taxes, city taxes, state taxes, employee taxes and federal taxes."

It seems unlikely to be an accident that the phrase "federal income tax" is missing from the tax litany in the Trump statement.

Then almost as though Trump can't help himself, the statement inadvertently goes to the question of why American voters might reasonably demand that he release his full tax returns – in the absence of a political record, Trump's claim on the presidency is based on his belief that he is the most brilliant businessman in the US.

The statement continued: "Mr Trump knows that tax code far better than anyone who has ever run for president, and he's the only one who knows how to fix it."

Trump himself hit out on Twitter with an almost identical pitch.

In 1995, Trump claimed to be worth about $2 billion. But according to the leaked documents, he claimed only $6108 in salary and tips and a further $7.5 million in interest income.

He also was able to use generous but legal tax loopholes to claim losses of $15.8 million on his expansive real estate holdings.

Reviewing the tax documents in the context of what was known of Trump's business in the years leading up to his 1995 return, the experts consulted by the Times pointed to a tax device – known as a net operating loss or a NOL – prized among American dynastic families that resort to holding their wealth in Byzantine corporate structures, and which allows an incredible range of high-value business expenses and losses to flow through to the personal tax return of the likes of Trump, where they serve to remove huge and real income streams from his taxable income.

These losses don't apply for just a single year – they can be applied retroactively to income in the three preceding years and for up to 15 years into the future.

In the years before 1995, Trump was in big financial trouble – reportedly on the verge of collapse, he was carrying $3.4 billion in debt, about a quarter of which he had personally guaranteed; and his casinos and airline were reportedly losing tens of millions of dollars.

Currently, Trump's various businesses could be carrying up to $1 billion in debt, which, the Times calculated, based on an average interest rate of 4 per cent, could be worth $10 million to $40 million a year as a deduction on Trump's personal federal income tax.

The source of some of that debt has drawn speculation since a comment back in 2008, by Trump's son Donald Junior, in explaining that Russian investors accounted for a disproportionate share of their assets – "we see a lot of money pouring in from Russia".

Based on public documents held by casino licensing and other agencies, Politico magazine has reported that Trump probably paid no tax in 1991 and 1993. Others have reported that Trump paid no federal income tax in 1978, 1979 and 1984; and that between 1975 and 1977, he paid about $71,000 on taxable income of a little more than $200,000.

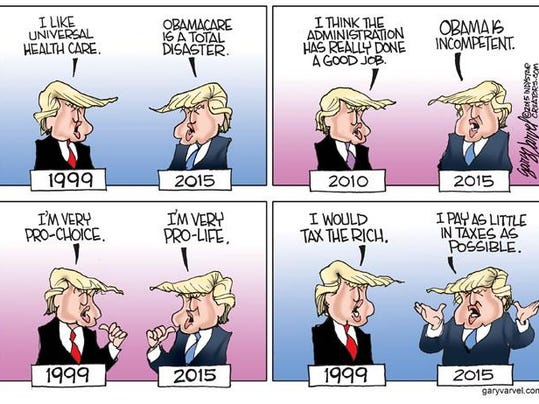

The situation is even more astonishing when you consider how outspoken Trump has been in the past about others who he says haven't paid their fair share of taxes.

"This is a perfectly legal application of the tax code, and he (Trump) would've been a fool not to take advantage of it."

In Florida, The New York Times tracked down the accountant who prepared the leaked Trump documents, the now 80-year-old Jack Mitnick, who declared what he was shown to be "legit!"

Mitnick said he couldn't possibly divulge any of the detail of Trump's finances without his former client's consent. But then, the old boy went on to say so much more.

He explained that in helping many wealthy New Yorkers down the years, there were times when he found it difficult to face the incongruity of his work – he knew that Trump lived in great luxury, in part because of the work that he, Mitnick, put into preparing Trump's tax papers.

"Here the guy was, building incredible net worth and not paying tax on it," Mitnick said.....OOPS! Better shut up Mr Mitnick before you're sued by the Donald for breach of confidentiality.

No comments:

Post a Comment

Through this ever open gate

None come too early

None too late

Thanks for dropping in ... the PICs